The Taxing Truth: What You Need to Know About SBR Tax Stamps

For firearms enthusiasts and self-defense advocates, navigating the legalities of owning a short-barrel rifle (SBR) can be as perplexing as it is frustrating. You’ve got your eye on that compact AR-15, or you’re considering customizing your current rifle into an SBR setup, but there’s a hurdle: dreaded SBR tax stamps.

This seemingly small piece of paper stands between you and lawful ownership, wrapped in red tape and complex regulations.

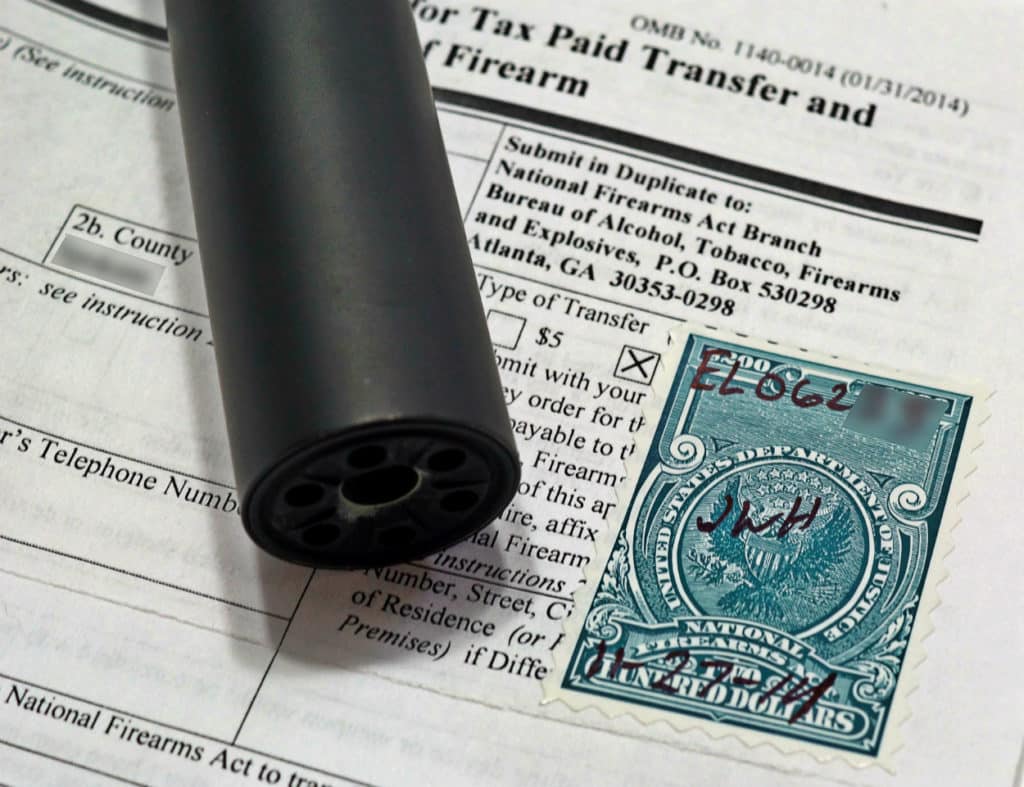

Here’s something crucial to know — getting that SBR isn’t just about paying up; it involves a $200 tax stamp that requires approval from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

But don’t let this discourage you. Our article peels back the layers of confusion surrounding SBR tax stamps with straightforward guidance to help you legally acquire your desired firearm.

From understanding what qualifies as an SBR to sifting through misconceptions about suppressors versus silencers — we’ve got answers. Get ready for insights that will clarify the path ahead and put responsible gun ownership within reach!

Disclaimer: Laws and regulations can change at any time. It is recommended that you do your own research to ensure all information is up-to-date with the filing process to acquire your SBR tax stamp.

Key Takeaways

- SBR tax stamps are mandatory for owning short-barrel rifles and involve a $200 fee paid to the ATF, along with a comprehensive application process that includes background checks.

- The process of registering an SBR varies by state, with additional permits or restrictions possibly required; always verify local laws alongside federal requirements.

- Applicants for an SBR tax stamp must submit fingerprints, photographs, and complete specific forms (ATF Form 1 for creating an SBR or Form 4 for purchasing one), resulting in waiting times that can last several months.

- Misunderstandings such as confusing suppressors with silencers and the role of Federal Firearms Licenses (FFL) in firearm transactions highlight the importance of accurate information when dealing with NFA items like SBRs.

- Utilizing an NFA gun trust can offer benefits, including shared ownership possibilities and privacy protection during the application process; staying informed on procedure updates helps avoid scams.

Table of contents

Understanding Short-Barrel Rifles and Their Classification

A Short-Barrel Rifle (SBR) refers to a rifle with a barrel length less than 16 inches or an overall length of less than 26 inches. SBRs are regulated under the National Firearms Act (NFA), and their classification is essential for understanding the legal requirements and restrictions associated with owning one.

What is a Short Barrel Rifle?

A short-barrel rifle, commonly known as an SBR, packs the power of a traditional rifle into a more compact frame. It’s defined by its barrel length — under 16 inches — or an overall length that falls short of 26 inches.

To many self-defense enthusiasts and firearms connoisseurs, the allure of an SBR lies in its portability and ease of maneuvering without sacrificing the firepower found in larger rifles.

Obtaining one of these firearms isn’t as simple as purchasing a regular handgun or hunting rifle; it requires navigating the National Firearms Act (NFA) regulations first established back in 1934.

This includes submitting ATF Form 1 for approval before you can legally own or make an SBR. Keep engraving requirements and background checks on your radar, too — they ensure your firearm is fully registered under NFA laws.

With its unique combination of size and strength, the short-barrel rifle remains a prized addition to any serious gun collection, demanding both respect for its capabilities and compliance with federal law.

What Defines an SBR?

An SBR, or short-barreled rifle, is a term for rifles with barrels shorter than 16 inches or an overall length less than 26 inches. Under the National Firearms Act (NFA) of 1934, these firearms require special handling and registration due to their compact size.

The classification of a rifle as an SBR brings it under stricter federal regulations compared to standard rifles.

Owners must register their SBRs with the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF), paying a $200 tax stamp fee as part of this process. Converting a pistol to an SBR is common; however, if you attach a stock without following proper ATF procedures and obtaining the necessary tax stamp, you’re violating federal law.

Related Article: The Benefits of an AR Pistol For Home Defense

It’s crucial that enthusiasts understand these guidelines clearly to ensure they remain on the right side of the law while enjoying their NFA items legally.

Short Barrel Rifle Laws & State Restrictions on SBRs (NFA Firearm)

Short-barrel rifles, known as SBRs, face various restrictions that differ from state to state. Understanding these laws is crucial for firearm enthusiasts to stay within legal boundaries.

- Some states prohibit the possession of SBRs entirely, leaving no room for civilians to own these firearms legally.

- Other states allow SBR ownership but require strict adherence to both federal and state registration processes.

- Local laws may impose additional requirements beyond federal standards, such as special permits or further background checks.

- Certain states demand that the barrel length and overall gun size meet specific measurements different than federal guidelines.

- A few states have enacted unique tax stamps or fees for SBR owners, which are supplemental to the national NFA tax stamp.

- Direct purchase of an SBR from a gun store may be limited in some areas; instead, individuals may need to convert a rifle through proper channels.

- States like California have assault weapon regulations that classify SBRs under restricted categories, complicating ownership further.

- Jurisdictions might change their stance on SBRs frequently; it’s essential for gun trust holders and owners to keep up-to-date with current legislation.

- Legal transport of an SBR across state lines often involves notifying the ATF via Form 20 prior to travel.

- Each state’s definition of what constitutes a pistol brace or a vertical grip can influence whether your firearm is classified as an SBR.

The SBR Tax Stamp Process

Do you want to get an SBR tax stamp? Perhaps you have an AR pistol and want to convert it to an SBR? Or are you looking to buy an SBR that is pre-built? You need to get your AFT-approved NFA tax stamp and go through the process to get a registered SBR.

Applying for an SBR and AFT tax stamp involves completing specific forms and paying the required fee to the ATF. The process also includes a waiting period for approval, during which background checks and other vetting procedures are conducted.

How to Apply for an SBR Tax Stamp

To apply for an SBR Tax Stamp, follow these steps:

Step 1: Complete ATF Form 1 accurately with all required information.

Step 2: Submit your fingerprints, photos, and the $200 check along with the form.

Step 3: Wait for the ATF to approve your application.

Step 4: Ensure compliance with state and local laws governing SBRs.

Step 5: Keep an eye out for any waivers or fee changes regarding SBR tax stamps.

Cost of SBR Tax Stamp

The cost of an SBR Tax Stamp is typically $200, and it’s a crucial part of the process to legally obtain a short-barrel rifle. However, during certain periods, the ATF may waive this fee for qualifying Form 1 SBR submissions.

Additionally, there have been discussions about a potential increase in the NFA tax stamp price to $500, reflecting a need for those interested in purchasing an SBR to stay updated on any changes or waivers concerning the tax stamp fees.

Individuals seeking to buy an SBR should be prepared for this financial investment and stay informed about any potential adjustments in the associated costs. Being aware of any changes can help them navigate through the process smoothly and avoid unnecessary delays or surprises later on.

Wait Time for SBR Tax Stamp Approval

The approval wait time for an SBR tax stamp can be a concern, as it ranges from several months to over a year. This extended period is due to the review process by the ATF, which involves thorough background checks and scrutiny of the submitted application.

Additionally, fluctuations in application volumes and regulations may affect processing times further.

Is the ATF Tax Stamp a One Time Fee?

A common question generally asked comes down to is the ATF tax stamp a one time fee? And that’s a great and valid question because who would want to pay a $200 tax stamp multiple times?

As of the publication date of this article, the tax stamp issued by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) in the United States for items such as silencers (suppressors), short-barreled rifles, and other controlled items is typically a one-time fee.

Once you pay the tax stamp for a particular item, you usually do not need to pay it again if you keep possession of that item. However, it’s crucial to stay updated with the latest laws and regulations, as changes may occur.

For the most current and accurate information, it is recommended to check with the ATF or consult legal professionals familiar with firearms regulations.

How to Register and Purchase an SBR (AR)

To register and purchase an SBR, you will need to complete ATF Form 1 or Form 4, depending on whether you are making a new firearm or purchasing an existing one. This process involves submitting the necessary paperwork and paying the required tax stamp fee.

Understanding these steps is crucial for legally acquiring an SBR. Are you interested in diving deeper into this topic? Keep reading to learn more about the ins and outs of SBR tax stamps!

Completing ATF Form 1 and Form 4 for a Short-Barreled Rifle

To complete ATF Form 1 and Form 4 for SBR tax stamps, follow these steps in order to remain “legal” in the eyes of the ATF:

- Fill out the required information on the ATF Form 1 or Form 4 accurately and completely.

- Submit fingerprints, photos, and a $200 check along with your form for processing.

- Ensure that all responsible persons involved in the transaction fill out ATF Form 5320.23 if applicable.

- Wait for approval from the ATF, which may take some time, depending on current processing times, but you’ll get the tax stamp in the mail.

- Once you get your tax stamp back and the stamp is approved, engrave the assigned serial number onto your SBR as per NFA regulations.

- Keep documentation of your approved tax stamp with your firearm at all times as proof of compliance with NFA regulations.

Common Misconceptions and Confusion

Many people confuse suppressors with silencers, but they are actually the same thing. It’s also important to understand the role of a Federal Firearms License (FFL) and how an NFA gun trust can be advantageous when dealing with SBRs and tax stamps.

Avoiding NFA tax stamp scams is crucial for navigating the process successfully.

Do You Want to Buy a Suppressor or Silencer? Here’s the Difference Between the Two

A common misconception in the firearms world is the interchangeable use of “suppressor” and “silencer.” While both devices serve to reduce the sound produced by a firearm when discharged, they differ slightly in function.

Related Article: Strategic Support — Choosing and Using the Ideal Rifle Sling

A suppressor reduces the noise generated when a gun is fired, making it less intense and more manageable for hearing protection. On the other hand, a silencer aims to completely eliminate or silence the audible report of gunfire.

The distinction between these terms can help enthusiasts make informed decisions based on their specific needs and preferences.

The Role of a Federal Firearms License (FFL)

To legally engage in the business of selling firearms, including short-barrel rifles (SBRs), a Federal Firearms License (FFL) is required. This license permits individuals to manufacture, import, or sell firearms and ammunition as part of their business activities.

Related Article: The TRUTH About Buying a Firearm — You’re Being Lied To

It also enables them to deal with National Firearm Act (NFA) regulated items, such as SBRs and suppressors. By obtaining an FFL, individuals can navigate through the legal processes involved in dealing with these specialized firearms and ensure compliance with federal regulations.

Moreover, having an FFL streamlines the process of acquiring NFA items like SBRs by allowing licensees to handle transfers directly. This not only facilitates smoother transactions but also provides access to a broader range of clientele seeking regulated firearms and accessories.

Advantages of Using a NFA Gun Trust

An NFA gun trust offers several advantages, especially for firearm enthusiasts. Firstly, national gun trusts allow multiple individuals to be listed as trustees, enabling shared ownership and use of the firearms without the need for additional background checks or fingerprint submissions for each trustee.

This flexibility is especially beneficial for those who want their family members or friends to have legal access to their NFA items. Additionally, an NFA gun trust can simplify the process of transferring regulated items after the owner’s passing, avoiding potential legal complications or delays in inheritance.

Furthermore, utilizing a trust can provide an extra layer of privacy and confidentiality as it prevents personal information such as fingerprints and photographs from being submitted directly to ATF during the application process.

Avoiding NFA Tax Stamp Scams

To avoid NFA tax stamp scams, here are some key steps and tips to keep in mind:

1. Research the Process: Understand the legitimate steps and requirements for obtaining an NFA tax stamp. Familiarize yourself with the official forms, fees, and processes involved in acquiring the stamp.

2. Verify Accredited Sources: Ensure that you obtain information from trusted sources such as the ATF website, licensed firearms dealers, or legal professionals specializing in NFA regulations.

3. Watch Out for Unrealistic Promises: Be cautious of any entities or individuals promising expedited processing times or guaranteed approvals for a fee. The process can take time and is subject to regulatory scrutiny.

4. Beware of Unauthorized Requests: Do not provide personal or financial information unless it is within the official channels and required documentation for the NFA tax stamp application process.

5. Seek Legal Counsel if Uncertain: If you encounter unfamiliar terms or requests that seem suspicious, consider consulting with an attorney knowledgeable about firearms laws and NFA regulations to ensure your compliance.

6. Stay Informed about Updates: Regularly check for updates on NFA regulations, changes in fees, or procedural adjustments to ensure that you follow current guidelines for obtaining your tax stamp.

7. Report Suspected Fraud: If you come across any potential scams related to NFA tax stamps, report them to the appropriate authorities, such as the ATF or local law enforcement agencies.

8. Don’t Rush Decisions: Take your time through each step of the process and avoid making hasty decisions when it comes to obtaining your NFA tax stamp.

9. Be Wary of Unsolicited Offers: Exercise caution when approached by individuals or companies offering assistance with acquiring an NFA tax stamp without prior solicitation on your part.

Become an SBR Tax Stamp Collector

To wrap this all up, understanding the SBR tax stamp process and how to navigate it is vital for firearms enthusiasts. With a clear grasp of the steps involved in obtaining an SBR tax stamp, individuals can streamline the application process and avoid common misconceptions.

Related Article: Castle Doctrine Explained — Protecting Your Home & Loved Ones

By grasping the practical aspects like completing ATF Form 1 and Form 4, applicants can ensure efficiency in their endeavors. How will you utilize this newfound knowledge to proceed with confidence toward acquiring your own SBR tax stamps? Take action today and explore the potential impact of integrating these strategies into your firearm ownership journey.

As a side note to close out this article, if you want to support our website and are in need of any tactical gear (or any product for that matter), anything you purchase using our links below will provide us with a small commission. We don’t charge for our free content and our goal is to keep it that way. We don’t have a Patreon account to put things behind a paywall, nor do we sell pics of our feet on OnlyFans.

If you choose to use the links below and make a purchase (at no additional cost to you), we greatly appreciate your support as it helps us continue to publish free content (like this article) on our website:

- Optics Planet (use code SAS5 at checkout for 5% off)

- Amazon

We have also partnered with CCW Safe. It’s the concealed carry coverage that I personally have for myself and my family in the event we need to defend our lives. Feel free to use our CCW Safe link to sign up and get some coverage to protect yourself and your family.

Also if you have a product you would like us to check out and potentially review, please contact us and let’s discuss.

FAQs on SBR Tax Stamps

An SBR tax stamp is a required approval from the ATF to legally have an SBR (Short Barreled Rifle), which you get by completing ATF Form 4 or eForm 1 under the National Firearms Act of 1934.

To apply, you’ll need to fill out the ATF Form 1 if making your own SBR or Form 4 when buying one. You also need to complete the ATF 5320.23 questionnaire and submit all paperwork to the ATF with a check for your tax.

Yes, you can convert it into an SBR by filing a Form 1 application with the ATF and waiting for your approved NFA tax stamp before altering your firearm.

After submitting your forms and payment, you’ll need to wait until you receive a letter from the ATF saying that your application has been approved, and then they will send you the actual stamp in the mail.

In addition to filling out forms like eForm 1 or Form 4, you may also be required to provide fingerprints, photos, notify local law enforcement, and complete additional documents such as ATF Form 5330.20 certifying U.S citizenship.

With each new NFA item like suppressors or machine guns, even if already registered with an NFA weapon, there’s still a process requiring new paperwork submission, including another set of applications specific to those items before obtaining them legally.

*Disclosure: This article may contain affiliate links or ads, which means we earn a small commission at no extra cost to you if you make a purchase through these links. These commissions help support the operation and maintenance of our website, allowing us to continue producing free valuable content. Your support is genuinely appreciated, whether you choose to use our links or not. Thank you for being a part of our community and enjoying our content.

PLEASE CONSIDER SHARING THIS ON YOUR SOCIAL MEDIA TO HELP OTHERS LEARN MORE ABOUT THIS TOPIC.